Business, 27.08.2019 18:00 naocarolina6

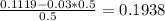

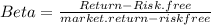

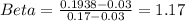

An investor has a portfolio with an expected return of 11.19%. the portfolio is evenly invested in a stock and a risk-free asset. the market has an expected return of 17% and the risk-free asset has an expected return of 3%. what is the beta of the stock?

Answers: 3

Other questions on the subject: Business

Business, 22.06.2019 12:30, victorialeona81

Provide an example of open-ended credit account that caroline has. caroline blue's credit report worksheet.

Answers: 1

Business, 22.06.2019 17:40, payloo

To appeal to a new target market, the maker of hill's coffee has changed the product's package design, reformulated the coffee, begun advertising price discounts in women's magazines, and started distributing the product through gourmet coffee shops. what has been changed? a. the product's perceptual value. b. the product's 4ps. c. the method used in its target marketing. d. the ownership of the product line. e. the product's utility.

Answers: 3

Business, 22.06.2019 20:30, Roof55

When patey pontoons issued 4% bonds on january 1, 2018, with a face amount of $660,000, the market yield for bonds of similar risk and maturity was 5%. the bonds mature december 31, 2021 (4 years). interest is paid semiannually on june 30 and december 31?

Answers: 1

You know the right answer?

An investor has a portfolio with an expected return of 11.19%. the portfolio is evenly invested in a...

Questions in other subjects:

English, 17.02.2020 23:47

Mathematics, 17.02.2020 23:47

Mathematics, 17.02.2020 23:47

Mathematics, 17.02.2020 23:48

History, 17.02.2020 23:48