Business, 20.08.2019 20:30 carterlapere

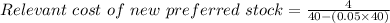

Tempo corp. will issue preferred stock to finance a new artillery line. the firm's existing preferred stock pays a dividend of $4.00 per share and is selling for $40 per share. investment bankers have advised tempo that flotation costs on the new preferred issue would be 5% of the selling price. tempo's marginal tax rate is 30%. what is the relevant cost of new preferred stock? a) 7.00%b) 7.37%c) 10.00%d) 10.53%e) 15.00%

Answers: 1

Other questions on the subject: Business

Business, 22.06.2019 02:00, whatistheinternetpas

True or false: a smart store layout moves customers in and out as fast as possible. a) true b) false

Answers: 2

Business, 22.06.2019 10:50, Nicki3729

The uptowner just paid an annual dividend of $4.12. the company has a policy of increasing the dividend by 2.5 percent annually. you would like to purchase shares of stock in this firm but realize that you will not have the funds to do so for another four years. if you require a rate of return of 16.7 percent, how much will you be willing to pay per share when you can afford to make this investment?

Answers: 3

Business, 22.06.2019 20:30, maguilarz2005

Contrast two economies that transitioned to capitalism and explain what factors affected the ease kf their transition as welas the “face” of capitalism that each has adopted

Answers: 2

You know the right answer?

Tempo corp. will issue preferred stock to finance a new artillery line. the firm's existing preferre...

Questions in other subjects:

Mathematics, 15.06.2020 20:57

Mathematics, 15.06.2020 20:57

Biology, 15.06.2020 20:57

Mathematics, 15.06.2020 20:57

History, 15.06.2020 20:57

Geography, 15.06.2020 20:57