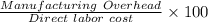

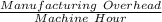

The silver corporation uses a predetermined overhead rate to apply manufacturing overhead to jobs. the predetermined overhead rate is based on labor cost in dept. a and on machine-hours in dept. b. at the beginning of the year, the corporation made the following estimates:

dept. a dept. b direct labor cost $60,000 $40,000 manufacturing overhead $90,000 $45,000 direct labor-hours 6,000 9,000 machine-hours 2,000 15,000

what predetermined overhead rates would be used in dept. a and dept. b, respectively?

(a) 67% and $3

(b) 67% and $5

(c) 150% and $3

Answers: 2

Other questions on the subject: Business

Business, 21.06.2019 22:10, jdiel14

Fess receives wages totaling $74,500 and has net earnings from self-employment amounting to $71,300. in determining her taxable self-employment income for the oasdi tax, how much of her net self-employment earnings must fess count? a. $74,500 b. $71,300 c. $53,900 d. $127,200 e. none of the above.

Answers: 3

Business, 22.06.2019 20:00, wallsdeandre6927

Richard is one of the leading college basketball players in the state of florida. he also maintains a good academic record. looking at his talent and potential, furman university offers to bear the expenses for his college education.

Answers: 3

Business, 23.06.2019 07:30, allierl2001

Which of the following conditions might result in the best financial decisions? a. agreeableness b. openness c. conscientiousness d. extraversion

Answers: 1

You know the right answer?

The silver corporation uses a predetermined overhead rate to apply manufacturing overhead to jobs. t...

Questions in other subjects:

History, 24.01.2020 15:31

Social Studies, 24.01.2020 15:31

History, 24.01.2020 15:31

Biology, 24.01.2020 15:31

English, 24.01.2020 15:31

Mathematics, 24.01.2020 15:31