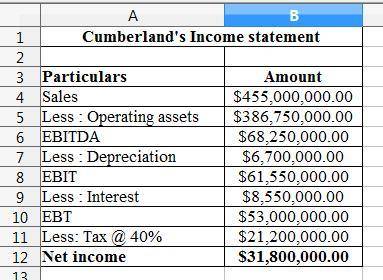

Cumberland industries' most recent sales were $455,000,000; operating costs (excluding depreciation) were equal to 85% of sales; net fixed assets were $67,000,000; depreciation amounted to 10% of net fixed assets; interest expenses were $8,550,000; the state-plus-federal corporate tax rate was 40% and cumberland paid 25% of its net income out in dividends. given this information, construct cumberland's income statement. also calculate total dividends and the addition to retained earnings.

Answers: 1

Other questions on the subject: Business

Business, 21.06.2019 22:50, emmanuelcampbel

What happens when a bank is required to hold more money in reserve?

Answers: 3

Business, 22.06.2019 02:00, camperangie3364

Jamie lee is reviewing her finances one month later. she has provided the actual amounts paid below. use the cash budget table below to her identify the variances in her budget. each answer must have a value for the assignment to be complete. enter "0" for any unused categories. actual amounts income: monthly expenses: gross monthly salary $2,315 rent obligation $260 net monthly salary $1,740 utilities/electricity $130 savings allocation: utilities/water $10 regular savings $130 utilities/cable tv $155 rainy-day savings $20 food $160 entertainment: gas/maintenance $205 cake decorating class $90 credit card payment $25 movies with friends $50 car insurance $75 clothing $145 budgeted amounts assets: monthly expenses: checking account $1,850 rent obligation $225 emergency fund savings account $4,300 utilities/electricity $75 car $5,200 utilities/water $35 computer & ipad $1,100 utilities/cable tv $120 liabilities: food $115 student loan $6,600 gas/maintenance $95 credit card balance $1,000 credit card payment $45 income: car insurance $45 gross monthly salary $2,155 clothing $45 net monthly salary $1,580 entertainment: savings allocation: cake decorating class $90 regular savings $130 movies with friends $50 rainy day savings $20

Answers: 2

Business, 22.06.2019 05:00, swelch2010

You are chairman of the board of a successful technology firm. there is a nominal federal corporate tax rate of 35 percent, yet the effective tax rate of the typical corporation is about 12.6%. your firm has been clever with use of transfer pricing and keeping money abroad and has barely paid any taxes over the last 5 years; during this same time period, profits were $28 billion. one member of the board feels that it is un-american to use various accounting strategies in order to avoid paying taxes. others feel that these are legal loopholes and corporations have a fiduciary responsibility to minimize taxes. one board member quoted what the ceo of exxon once said: “i’m not a u. s. company and i don’t make decisions based on what’s good for the u. s.” what are the alternatives? what are your recommendations? why do you recommend this course of action?

Answers: 2

Business, 22.06.2019 12:00, hannaboo53

Identify at least 3 body language messages that project a positive attitude

Answers: 2

You know the right answer?

Cumberland industries' most recent sales were $455,000,000; operating costs (excluding depreciation...

Questions in other subjects:

Mathematics, 25.07.2021 01:00

English, 25.07.2021 01:00

Mathematics, 25.07.2021 01:00

Mathematics, 25.07.2021 01:00