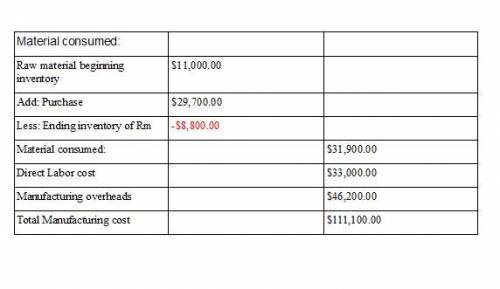

Hendrix & franks company had the following beginning and ending inventory balances for the current year ended december 31:

january 1 december 31

materials $11,000 $ 8,800

work in process 19,800 18,700

finished goods 23,100 18,150

in addition, direct labor costs of $33,000 were incurred, manufacturing overhead equaled $46,200, materials purchased were $29,700, and selling and administrative costs were $24,200. hendrix & franks co. sold 27,500 units of product during the year at a sales price of $5.25 per unit. what was the amount of cost of goods manufactured for the year?

a.$106,500

b.$102,000

c.$111,100

d.$123,000

Answers: 1

Other questions on the subject: Business

Business, 21.06.2019 16:20, hernandezeileen20

Match each of the terms below with an example that fits the term. a. fungibility the production of gasoline b. inelasticity the switch from coffee to tea c. non-excludability the provision of national defense d. substitution the demand for cigarettes

Answers: 3

Business, 22.06.2019 03:30, Geo777

Assume that all of thurmond company’s sales are credit sales. it has been the practice of thurmond company to provide for uncollectible accounts expense at the rate of one-half of one percent of net credit sales. for the year 20x1 the company had net credit sales of $2,021,000 and the allowance for doubtful accounts account had a credit balance, before adjustments, of $630 as of december 31, 20x1. during 20x2, the following selected transactions occurred: jan. 20 the account of h. scott, a deceased customer who owed $325, was determined to be uncollectible and was therefore written off. mar. 16 informed that a. nettles, a customer, had been declared bankrupt. his account for $898 was written off. apr. 23 the $906 account of j. kenney & sons was written off as uncollectible. aug. 3 wrote off as uncollectible the $750 account of clarke company. oct. 20 wrote off as uncollectible the $1,130 account of g. michael associates. oct. 27 received a check for $325 from the estate of h. scott. this amount had been written off on january 20 of the current year. dec. 20 cater company paid $7,000 of the $7,500 it owed thurmond company. since cater company was going out of business, the $500 balance it still owed was deemed uncollectible and written off. required: prepare journal entries for the december 31, 20x1, and the seven 20x2 transactions on the work sheets provided at the back of this unit. then answer questions 8 and 9 on the answer sheet. t-accounts are also provided for your use in answering these questions. 8. which one of the following entries should have been made on december 31, 20x1?

Answers: 1

Business, 22.06.2019 11:10, allieallie

Use the information below to answer the following question. the boxwood company sells blankets for $60 each. the following was taken from the inventory records during may. the company had no beginning inventory on may 1. date blankets units cost may 3 purchase 5 $20 10 sale 3 17 purchase 10 $24 20 sale 6 23 sale 3 30 purchase 10 $30 assuming that the company uses the perpetual inventory system, determine the gross profit for the month of may using the lifo cost method.

Answers: 1

Business, 22.06.2019 12:50, laxraAragon

Jallouk corporation has two different bonds currently outstanding. bond m has a face value of $50,000 and matures in 20 years. the bond makes no payments for the first six years, then pays $2,100 every six months over the subsequent eight years, and finally pays $2,400 every six months over the last six years. bond n also has a face value of $50,000 and a maturity of 20 years; it makes no coupon payments over the life of the bond. the required return on both these bonds is 10 percent compounded semiannually. what is the current price of bond m and bond n?

Answers: 3

You know the right answer?

Hendrix & franks company had the following beginning and ending inventory balances for the curr...

Questions in other subjects:

Mathematics, 17.09.2020 18:01

Mathematics, 17.09.2020 18:01

History, 17.09.2020 18:01

Mathematics, 17.09.2020 18:01

Mathematics, 17.09.2020 18:01

Mathematics, 17.09.2020 18:01

Mathematics, 17.09.2020 18:01

Mathematics, 17.09.2020 18:01

Mathematics, 17.09.2020 18:01

Mathematics, 17.09.2020 18:01