Business, 24.07.2019 22:20 cadenbukvich9923

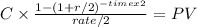

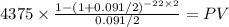

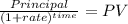

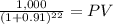

Assume the city of tulsa, oklahoma issued bonds 3 years ago as follows: 8.75% $150 million at 8.75%. the original maturity was 25 years, par value is $1,000, with interest paid annually. the original credit rating was a1/a+ by moody's and s& p, respectively. if the rating agencies downgrade the credit ratings to a3/a-, investors will want a 9.10% return. what would happen to the price per bond if that happens today? (6 decimal places).

Answers: 1

Other questions on the subject: Business

Business, 22.06.2019 01:20, Becky81

Which of the following statements concerning an organization's strategy is true? a. cost accountants formulate strategy in an organization since they have more inputs about costs. b. businesses usually follow one of two broad strategies: offering a quality product at a high price, or offering a unique product or service priced lower than the competition. c. a good strategy will always overcome poor implementation. d. strategy specifies how an organization matches its own capabilities with the opportunities in the marketplace to accomplish its objectives.

Answers: 1

Business, 22.06.2019 06:40, Amber423

As a finance manager at allsports communication, charlie worries about the firm's borrowing requirements for the upcoming year. he knows the benefit of estimating allsports' cash disbursements and short-term investment expectations. facing these concerns, a(n) would provide charlie with valuable information by providing a good estimation of whether the firm will need to do short-term borrowing. capital budget cash budget operating budget line item budget

Answers: 3

Business, 22.06.2019 10:40, emojigirl5754

Two assets have the following expected returns and standard deviations when the risk-free rate is 5%: asset a e(ra) = 18.5% σa = 20% asset b e(rb) = 15% σb = 27% an investor with a risk aversion of a = 3 would find that on a risk-return basis. a. only asset a is acceptable b. only asset b is acceptable c. neither asset a nor asset b is acceptable d. both asset a and asset b are acceptable

Answers: 2

You know the right answer?

Assume the city of tulsa, oklahoma issued bonds 3 years ago as follows: 8.75% $150 million at 8.75%...

Questions in other subjects:

Mathematics, 28.07.2019 21:50

Mathematics, 28.07.2019 21:50

History, 28.07.2019 21:50

Mathematics, 28.07.2019 21:50

History, 28.07.2019 21:50