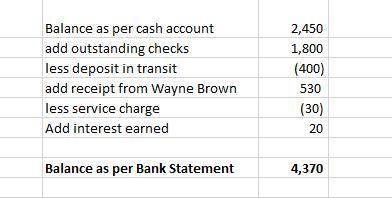

The cash account of safety security systems reported a balance of $ 2 comma 450 at december 31, 2018. there were outstanding checks totaling $ 1 comma 800 and a december 31 deposit in transit of $ 400. the bank statement, which came from park cities bank, listed the december 31 balance of $ 4 comma 370. included in the bank balance was a collection of $ 530 on account from wayne brown, a safety customer who pays the bank directly. the bank statement also shows a $ 30 service charge and $ 20 of interest revenue that safety earned on its bank balance. prepare safety's bank reconciliation at december 31.

Answers: 1

Other questions on the subject: Business

Business, 22.06.2019 11:50, Paytonsmommy09

Which of the following does not offer an opportunity for timely content? evergreen content news alerts content that suits seasonal consumption patterns content that matches a situational trigger content that addresses urgent pain points

Answers: 2

Business, 22.06.2019 19:40, biasmi70

Your father's employer was just acquired, and he was given a severance payment of $375,000, which he invested at a 7.5% annual rate. he now plans to retire, and he wants to withdraw $35,000 at the end of each year, starting at the end of this year. how many years will it take to exhaust his funds, i. e., run the account down to zero? a. 22.50 b. 23.63 c. 24.81 d. 26.05 e. 27.35

Answers: 2

Business, 22.06.2019 20:30, brooklyn5150

Casey communications recently issued new common stock and used the proceeds to pay off some of its short-term notes payable. this action had no effect on the company's total assets or operating income. which of the following effects would occur as a result of this action? a. the company's current ratio increased. b. the company's times interest earned ratio decreased. c. the company's basic earning power ratio increased. d. the company's equity multiplier increased. e. the company's debt ratio increased.

Answers: 3

You know the right answer?

The cash account of safety security systems reported a balance of $ 2 comma 450 at december 31, 2018...

Questions in other subjects:

Mathematics, 22.11.2019 17:31

Mathematics, 22.11.2019 17:31

Mathematics, 22.11.2019 17:31