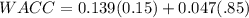

Sommer, inc., is considering a project that will result in initial aftertax cash savings of $1.79 million at the end of the first year, and these savings will grow at a rate of 3 percent per year indefinitely. the firm has a target debt-equity ratio of .85, a cost of equity of 11.9 percent, and an aftertax cost of debt of 4.7 percent. the cost-saving proposal is somewhat riskier than the usual project the firm undertakes; management uses the subjective approach and applies an adjustment factor of 2 percent to the cost of capital for such risky projects. what is the maximum initial cost the company would be willing to pay for the project?

Answers: 3

Other questions on the subject: Business

Business, 22.06.2019 03:30, jadahilbun01

Instructions: use the following information to construct the 2000 balance sheet and income statement for carolina business machines. round all numbers to the nearest whole dollar. all numbers are in thousands of dollars. be sure to read the whole problem before you jump in and get started. at the end of 1999 the firm had $43,000 in gross fixed assets. in 2000 they purchased an additional $14,000 of fixed asset equipment. accumulated depreciation at the end of 1999 was $21,000. the depreciation expense in 2000 is $4,620. at the end of 2000 the firm had $3,000 in cash and $3,000 in accounts payable. in 2000 the firm extended a total of $9,000 in credit to a number of their customers in the form of accounts receivable. the firm generated $60,000 in sales revenue in 2000. their cost of goods sold was 60 percent of sales. they also incurred salaries and wages expense of $10,000. to date the firm has $1,000 in accrued salaries and wages. they borrowed $10,000 from their local bank to finance the $15,000 in inventory they now have on hand. the firm also has $7,120 invested in marketable securities. the firm currently has $20,000 in long-term debt outstanding and paid $2,000 in interest on their outstanding debt. over the firm's life, shareholders have put up $30,000. eighty percent of the shareholder's funds are in the form of retained earnings. the par value per share of carolina business machines stock is

Answers: 3

Business, 22.06.2019 10:10, cuthbertson157

conquest, inc. produces a special kind of light-weight, recreational vehicle that has a unique design. it allows the company to follow a cost-plus pricing strategy. it has $9,000,000 of average assets, and the desired profit is a 10% return on assets. assume all products produced are sold. additional data are as follows: sales volume 1000 units per year; variable costs $1000 per unit; fixed costs $4,000,000 per year; using the cost-plus pricing approach, what should be the sales price per unit?

Answers: 2

Business, 22.06.2019 13:20, Jasten

Suppose your rich uncle gave you $50,000, which you plan to use for graduate school. you will make the investment now, you expect to earn an annual return of 6%, and you will make 4 equal annual withdrawals, beginning 1 year from today. under these conditions, how large would each withdrawal be so there would be no funds remaining in the account after the 4th withdraw?

Answers: 3

You know the right answer?

Sommer, inc., is considering a project that will result in initial aftertax cash savings of $1.79 mi...

Questions in other subjects:

Health, 26.01.2021 15:20

Mathematics, 26.01.2021 15:20

Mathematics, 26.01.2021 15:20

Mathematics, 26.01.2021 15:20

Computers and Technology, 26.01.2021 15:20

English, 26.01.2021 15:20