Business, 22.07.2019 02:10 NotYourStudent

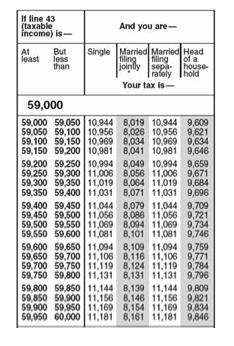

Christian's taxable income last year was $59,450. according to the tax table below, how much tax does he have to pay if he files with the "single" status? a. $11,044 b. $11,056 c. $8086 d. $9271

2b2t

Answers: 3

Other questions on the subject: Business

Business, 22.06.2019 11:30, Svetakotok

Margaret company reported the following information for the current year: net sales $3,000,000 purchases $1,957,000 beginning inventory $245,000 ending inventory $115,000 cost of goods sold 65% of sales industry averages available are: inventory turnover 5.29 gross profit percentage 28% how do the inventory turnover and gross profit percentage for margaret company compare to the industry averages for the same ratios? (round inventory turnover to two decimal places. round gross profit percentage to the nearest percent.)

Answers: 2

You know the right answer?

Christian's taxable income last year was $59,450. according to the tax table below, how much tax doe...

Questions in other subjects:

Mathematics, 09.06.2021 20:30

Mathematics, 09.06.2021 20:30

Mathematics, 09.06.2021 20:30

Mathematics, 09.06.2021 20:30