Business, 19.07.2019 21:30 nananunu2747

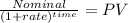

Assume today is december 31, 2013. imagine works inc. just paid a dividend of $1.15 per share at the end of 2013. the dividend is expected to grow at 18% per year for 3 years, after which time it is expected to grow at a constant rate of 6% annually. the company's cost of equity (rs) is 9.5%. using the dividend growth model (allowing for nonconstant growth), what should be the price of the company's stock today (december 31, 2013)? round your answer to the nearest cent. do not round intermediate calculations. $ per share

Answers: 2

Other questions on the subject: Business

Business, 22.06.2019 10:30, pierrezonra

What are the positive environmental trends seen today? many industries are taking measures to reduce the use( _gold, carbon dioxide, ozone_) of -depleting substances and are turning to(_scarce, renewable, non-recyclable_) energy sources though they may seem expensive. choose one of those 3 option to fill the

Answers: 3

Business, 22.06.2019 11:00, hadwell34

You are attending college in the fall and you need to purchase a computer. you must finance the purchase because your parents will not purchase it for you, and you do not have the cash on hand to purchase it. in blank #1 determine which type of credit would you use to finance your purchase (installment, non-installment, or revolving credit). (2 points) in blank #2 defend your credit choice by explaining why your financing option is the best option for you. (2 points) in blank #3 explain why you selected that credit option over the other two options available. (2 points)

Answers: 3

Business, 22.06.2019 18:00, tifftiff22

On september 1, 2016, steve loaned brett $2,000 at 12% interest compounded annually. steve is not in the business of lending money. the note stated that principal and interest would be due on august 31, 2018. in 2018, steve received $2,508.80 ($2,000 principal and $508.80 interest). steve uses the cash method of accounting. what amount must steve include in income on his income tax return?

Answers: 1

Business, 22.06.2019 19:20, kristen17diaz

Garrett is an executive vice president at samm hardware. he researches a proposal by a larger company, maximum hardware, to combine the two companies. by analyzing past performance, conducting focus groups, and interviewing maximum employees, garrett concludes that maximum has poor profit margins, sells shoddy merchandise, and treats customers poorly. what actions should garrett and samm hardware take? a. turn down the acquisition offer and prepare to resist a hostile takeover. b. attempt a friendly merger and use managerial hubris to improve results at maximum. c. welcome the acquisition and use knowledge transfer to impart sam hardware's management practices. d. do nothing; the two companies cannot combine without samm hardware's explicit consent.

Answers: 1

You know the right answer?

Assume today is december 31, 2013. imagine works inc. just paid a dividend of $1.15 per share at the...

Questions in other subjects:

English, 22.08.2021 17:30

Mathematics, 22.08.2021 17:30

Mathematics, 22.08.2021 17:30

Biology, 22.08.2021 17:30

Mathematics, 22.08.2021 17:30

Biology, 22.08.2021 17:30

Chemistry, 22.08.2021 17:30

![\left[\begin{array}{ccc}Year&Dividends&Present Value\\1&1.357&1.23926940639269\\2&1.60126&1.33546840140948\\3&53.9853371428571&41.1181399520726\\Intrinsic&Value&43.6928777598748\\\end{array}\right]](/tpl/images/0109/2586/859d1.png)