Business, 18.07.2019 02:10 dashaunpeele

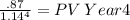

Computech corporation is expanding rapidly and currently needs to retain all of its earnings; hence, it does not pay dividends. however, investors expect computech to begin paying dividends, beginning with a dividend of $0.75 coming 3 years from today. the dividend should grow rapidly-at a rate of 16% per year-during years 4 and 5; but after year 5, growth should be a constant 8% per year. if the required return on computech is 14%, what is the value of the stock today? round your answer to the nearest cent. do not round your intermediate calculations.

Answers: 3

Other questions on the subject: Business

Business, 22.06.2019 01:10, ltawiah8393

Suppose someone wants to sell a piece of land for cash. the selling of a piece of land represents turning econ

Answers: 3

Business, 22.06.2019 03:00, itscheesycheedar

Compare the sources of consumer credit 1. consumers use a prearranged loan using special checks 2. consumers use cards with no interest and non -revolving balances 3. consumers pay off debt and credit is automatically renewed 4. consumers take out a loan with a repayment date and have a specific purpose a. travel and entertainment credit b. revolving check credit c. closed-end credit d. revolving credit

Answers: 1

Business, 23.06.2019 02:10, awesomegrill

Goldman services hired a new clerk to keep custody of and maintain all the equipment in the equipment yard. the clerk has not yet been adequately trained on the maintenance needs of the equipment. which internal control procedure needs strengthening?

Answers: 2

Business, 23.06.2019 02:20, maustin5323

Which one of the following is not a typical current liability? a. interest payable b. current maturities of long-term debt c. salaries payable d. mortgages payable

Answers: 3

You know the right answer?

Computech corporation is expanding rapidly and currently needs to retain all of its earnings; hence...

Questions in other subjects:

Social Studies, 20.07.2019 21:40

Mathematics, 20.07.2019 21:40

Mathematics, 20.07.2019 21:40

History, 20.07.2019 21:40

Social Studies, 20.07.2019 21:40

![\left[\begin{array}{ccc}-&DIVIDENDS&PRESENT VALUE\\1&0&0\\2&0&0\\3&0.75&0.506228637151512\\4&0.87&0.515109841312065\\5&1.0092&8.73578093453209\\Intrinsic&Value&9.75711941299567\\\end{array}\right]](/tpl/images/0102/3556/7a5e2.png)