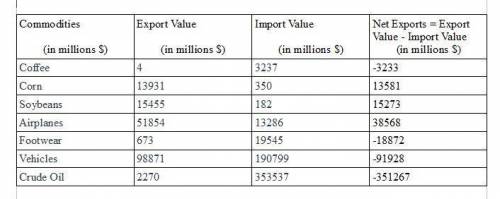

The data below is from the statistical abstract of the united states located on the internet specifically from tables in the section entitled "foreign commerce and aid." one of the tables lists u. s. exports and imports by selected standard industrial trade classification (sitc) commodity. complete the net export column in the table below: (enter all values as integers. remember to include a negative sign where appropriate.)

commodity export value import value net exports=exports-imports

($ millions) ($ millions) ($ millions)

coffee 4 3,237

corn 13,931 350

soybeans 15,455 182

airplanes 51,854 13,286

footwear 673 19,545

vehicles 98,871 190,799

crude oil 2,270 353,537

Answers: 2

Other questions on the subject: Business

Business, 21.06.2019 21:00, skifchaofficial01

Stephen barrett, md previous writing experience ?

Answers: 1

Business, 22.06.2019 16:00, knownperson233

In macroeconomics, to study the aggregate means to study blank

Answers: 1

Business, 22.06.2019 17:00, allofthosefruit

Jillian wants to plan her finances because she wants to create and maintain her tax and credit history. she also wants to chart out all of her financial transactions for the past federal fiscal year. what duration should jillian consider to calculate her finances? from (march or january )to (december or april)?

Answers: 1

Business, 22.06.2019 21:30, girlhooper4life11

Suppose that alexi and tony can sell all their street tacos for $2 each and all their cuban sandwiches for $7.25 each. if each of them worked 20 hours per week, how should they split their time between the production of street tacos and cuban sandwiches? what is their maximum joint revenue?

Answers: 3

You know the right answer?

The data below is from the statistical abstract of the united states located on the internet specifi...

Questions in other subjects:

Spanish, 09.02.2021 21:20

Mathematics, 09.02.2021 21:20

Mathematics, 09.02.2021 21:20

Mathematics, 09.02.2021 21:20

Mathematics, 09.02.2021 21:20

Health, 09.02.2021 21:20