Business, 16.07.2019 02:10 sillslola816oxb5h7

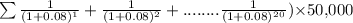

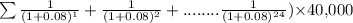

Stemway company requires a new manufacturing facility. it found three locations; all of which would provide the needed capacity, the only difference is the price. location a may be purchased for $500,000. location b may be acquired with a down payment of $100,000 and annual payments at the end of each of the next twenty years of $50,000. location c requires $40,000 payments at the beginning of each of the next twenty-five years. assuming stemway borrowing costs are 8% per annum, which option is the least costly to the company?

Answers: 1

Other questions on the subject: Business

Business, 22.06.2019 12:30, bcarri4073

M. cotteleer electronics supplies microcomputer circuitry to a company that incorporates microprocessors into refrigerators and other home appliances. one of the components has an annual demand of 235 units, and this is constant throughout the year. carrying cost is estimated to be $1.25 per unit per year, and the ordering (setup) cost is $21 per order. a) to minimize cost, how many units should be ordered each time an order is placed? b) how many orders per year are needed with the optimal policy? c) what is the average inventory if costs are minimized? d) suppose that the ordering cost is not $21, and cotteleer has been ordering 125 units each time an order is placed. for this order policy (of q = 125) to be optimal, determine what the ordering cost would have to be.

Answers: 1

Business, 22.06.2019 16:30, AriaMartinez

Corrective action must be taken for a project when (a) actual progress to the planned progress shows the progress is ahead of schedule. (b) the technical specifications have been met. (c) the actual cost of the activities is less than the funds received for the work completed. (d) the actual progress is less than the planned progress.

Answers: 2

Business, 22.06.2019 21:00, sofiaisabelaguozdpez

Roberto and reagan are both 25 percent owner/managers for bright light inc. roberto runs the retail store in sacramento, ca, and reagan runs the retail store in san francisco, ca. bright light inc. generated a $125,000 profit companywide made up of a $75,000 profit from the sacramento store, a ($25,000) loss from the san francisco store, and a combined $75,000 profit from the remaining stores. if bright light inc. is an s corporation, how much income will be allocated to roberto?

Answers: 2

You know the right answer?

Stemway company requires a new manufacturing facility. it found three locations; all of which would...

Questions in other subjects:

Social Studies, 20.03.2020 21:53

English, 20.03.2020 21:53

= 9.818 X $50,000 = $490,900

= 9.818 X $50,000 = $490,900 = $40,000 + 10.529 X $40,000 = $40,000 + $421,160 = $461,160

= $40,000 + 10.529 X $40,000 = $40,000 + $421,160 = $461,160