Oakmont company has an opportunity to manufacture and sell a new product for a four-year period. the company�s discount rate is 17%. after careful study, oakmont estimated the following costs and revenues for the new product:

cost of equipment needed $ 275,000

working capital needed $ 86,000

overhaul of the equipment in two years $ 10,000

salvage value of the equipment in four years $ 13,000

annual revenues and costs:

sales revenues $ 420,000

variable expenses $ 205,000

fixed out-of-pocket operating costs $ 87,000

when the project concludes in four years the working capital will be released for investment elsewhere within the company.

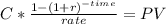

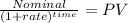

calculate the net present value of this investment opportunity.

Answers: 2

Other questions on the subject: Business

Business, 22.06.2019 08:30, cyaransteenberg

Blank is the internal operation that arranges information resources to support business performance and outcomes

Answers: 2

Business, 22.06.2019 16:10, olly09

The following are line items from the horizontal analysis of an income statement:increase/ (decrease) increase/ (decrease) 2017 2016 amount percent fees earned $120,000 $100,000 $20,000 20% wages expense 50,000 40,000 10,000 25 supplies expense 2,000 1,700 300 15 which of the items is stated incorrectly? a. fees earned b. supplies expense c. none of these choices are correct. d. wages expense

Answers: 3

Business, 22.06.2019 21:00, elenasoaita

Describe what fixed costs and marginal costs mean to a company.

Answers: 1

You know the right answer?

Oakmont company has an opportunity to manufacture and sell a new product for a four-year period. the...

Questions in other subjects:

Biology, 28.01.2020 16:46

History, 28.01.2020 16:46

History, 28.01.2020 16:46

Social Studies, 28.01.2020 16:46

Physics, 28.01.2020 16:46

Mathematics, 28.01.2020 16:46