Business, 12.07.2019 03:10 ConnorRecck3140

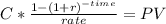

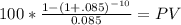

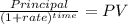

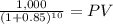

Bond valuation with semi-annual payments: renfro rentals has issued bonds that have a 10% coupon rate, payable semiannually. the bonds mature in 8 years, have a face value of $1,000, and a yield to maturity of 8.5%. what is the price of the bonds?

Answers: 1

Other questions on the subject: Business

Business, 21.06.2019 23:00, E1nst31n44

You and your new australian bride matilda, are applying for a loan and are required to submit a balance sheet with your net worth. you own a 2008 toyota camry that you bought last month for $9,995. the kelly blue book value for this car is $13,995. you owe $8,150 on the car loan for the camry. you pay off your visa credit card every month and have not paid any credit card interest this year. the current visa credit card balance is $3,522, and the next statement is due in 15 days. you have a student loan balance of $6,500. you presently have $425 in your checking account and $1,540 in your savings account. you own 100 shares of ibm stock that you purchased for $85.50 per share. one share of ibm is now selling for $158.42. you own computers and other electronics that you purchased for $4,100 but could probably sell today on e-bay for $1,800. your gross income is $80,000 per year. what is your current net worth? (see wb ch. 2 example 2.3)

Answers: 1

Business, 22.06.2019 20:30, lareynademividp0a99r

The smelting department of kiner company has the following production and cost data for november. production: beginning work in process 3,700 units that are 100% complete as to materials and 23% complete as to conversion costs; units transferred out 10,500 units; and ending work in process 8,100 units that are 100% complete as to materials and 41% complete as to conversion costs. compute the equivalent units of production for (a) materials and (b) conversion costs for the month of november.

Answers: 3

Business, 23.06.2019 02:00, kittybatch345

What percentage of hard rock's profit is derived from retail shop sales?

Answers: 1

Business, 23.06.2019 10:00, dianamunoz580

Avillage levied property taxes of $910,000 for calendar year 2019 on january 1, 2019 and immediately set up an allowance of $10,000 for uncollectible taxes. the village collected $870,000 in cash during 2019. it expected to collect $22,000 of the unpaid taxes during the first 60 days of 2020 and an additional $8,000 during the rest of 2020. how much should the village recognize as property tax revenues in its 2019 general fund financial statements? a) $870,000 b) $892,000 c) $900,000 d) $910,000

Answers: 1

You know the right answer?

Bond valuation with semi-annual payments: renfro rentals has issued bonds that have a 10% coupon ra...

Questions in other subjects:

Mathematics, 26.08.2021 20:20

Physics, 26.08.2021 20:20

Mathematics, 26.08.2021 20:20

Mathematics, 26.08.2021 20:20

Physics, 26.08.2021 20:20

Mathematics, 26.08.2021 20:20

Biology, 26.08.2021 20:20