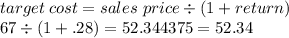

Shimada products corporation of japan is anxious to enter the electronic calculator market. management believes that in order to be competitive in world markets, the price of the electronic calculator that the company is developing cannot exceed $67. shimada’s required rate of return is 28% on all investments. an investment of $3,100,000 would be required to purchase the equipment needed to produce the 42,000 calculators that management believes can be sold each year at the $67 price. required: compute the target cost of one calculator

Answers: 3

Other questions on the subject: Business

Business, 22.06.2019 02:00, gracye

Kenney co. uses process costing to account for the production of canned energy drinks. direct materials are added at the beginning of the process and conversion costs are incurred uniformly throughout the process. equivalent units have been calculated to be 19,200 units for materials and 16,000 units for conversion costs. beginning inventory consisted of $11,200 in materials and $6,400 in conversion costs. april costs were $57,600 for materials and $64,000 for conversion costs. ending inventory still in process was 6,400 units (100% complete for materials, 50% for conversion). the total cost per unit using the weighted average method would be closest to:

Answers: 2

Business, 22.06.2019 08:00, shatj960

Suppose the number of equipment sales and service contracts that a store sold during the last six (6) months for treadmills and exercise bikes was as follows: treadmill exercise bike total sold 185 123 service contracts 67 55 the store can only sell a service contract on a new piece of equipment. of the 185 treadmills sold, 67 included a service contract and 118 did not.

Answers: 1

Business, 22.06.2019 12:50, 20170020

Kyle and alyssa paid $1,000 and $4,000 in qualifying expenses for their two daughters jane and jill, respectively, to attend the university of california. jane is a sophomore and jill is a freshman. kyle and alyssa's agi is $135,000 and they file a joint return. what is their allowable american opportunity tax credit after the credit phase-out based on agi is taken into account?

Answers: 1

You know the right answer?

Shimada products corporation of japan is anxious to enter the electronic calculator market. manageme...

Questions in other subjects:

Mathematics, 22.10.2020 18:01

Mathematics, 22.10.2020 18:01

Biology, 22.10.2020 18:01

History, 22.10.2020 18:01

Biology, 22.10.2020 18:01

English, 22.10.2020 18:01