Business, 09.07.2019 04:30 shadowsnake

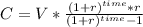

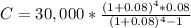

Ian loaned his friend $30,000 to start a new business. he considers this loan to be an investment, and therefore requires his friend to pay him an interest rate of 8% on the loan. he also expects his friend to pay back the loan over the next four years by making annual payments at the end of each year. ian texted and asked that you him calculate the annual payments that he should expect to receive so that he can recover his initial investment and earn the agreed-upon 8% on his investment.

Answers: 2

Other questions on the subject: Business

Business, 22.06.2019 01:00, avablankenship

Data pertaining to the current position of forte company are as follows: cash $437,500 marketable securities 170,000 accounts and notes receivable (net) 320,000 inventories 700,000 prepaid expenses 42,000 accounts payable 240,000 notes payable (short-term) 250,000 accrued expenses 310,000 required: 1. compute (a) the working capital, (b) the current ratio, and (c) the quick ratio. round ratios to one decimal place. 2. compute the working capital, the current ratio, and the quick ratio after each of the following transactions, and record the results in the appropriate columns of the table provided. consider each transaction separately and assume that only that transaction affects the data given. round to one decimal place. a. sold marketable securities at no gain or loss, 75,000. b. paid accounts payable, 135,000. c. purchased goods on account, 100,000. d. paid notes payable, 105,000. e. declared a cash dividend, 125,000. f. declared a common stock dividend on common stock, 45,000. g. borrowed cash from bank on a long-term note, 205,000. h. received cash on account, 130,000. i. issued additional shares of stock for cash, 635,000. j. paid cash for prepaid expenses, 15,000.

Answers: 3

Business, 22.06.2019 15:00, nando3024

Magic realm, inc., has developed a new fantasy board game. the company sold 15,000 games last year at a selling price of $20 per game. fixed expenses associated with the game total $182,000 per year, and variable expenses are $6 per game. production of the game is entrusted to a printing contractor. variable expenses consist mostly of payments to this contractor. required: 1-a. prepare a contribution format income statement for the game last year.1-b. compute the degree of operating leverage.2. management is confident that the company can sell 58,880 games next year (an increase of 12,880 games, or 28%, over last year). given this assumption: a. what is the expected percentage increase in net operating income for next year? b. what is the expected amount of net operating income for next year? (do not prepare an income statement; use the degree of operating leverage to compute your answer.)

Answers: 2

Business, 23.06.2019 12:00, kaylallangari1509

What could increase the value of your property

Answers: 1

You know the right answer?

Ian loaned his friend $30,000 to start a new business. he considers this loan to be an investment, a...

Questions in other subjects:

History, 29.11.2021 07:00

Mathematics, 29.11.2021 07:00

History, 29.11.2021 07:00