Business, 15.01.2020 21:31 kevinmarroquin6

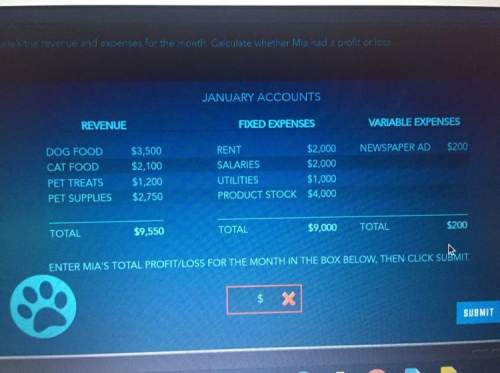

If a revenue in total for a month was $9459, fixed expenses were $9,000 and variable expenses were $0 what would be the total profit/loss for the month?

Answers: 1

Other questions on the subject: Business

Business, 22.06.2019 10:50, hsjsjsjdjjd

Suppose that a firm is considering moving from a batch process to an assembly-line process to better meet evolving market needs. what concerns might the following functions have about this proposed process change: marketing, finance, human resources, accounting, and information systems?

Answers: 2

Business, 22.06.2019 11:40, maddied2443

The following pertains to smoke, inc.’s investment in debt securities: on december 31, year 3, smoke reclassified a security acquired during the year for $70,000. it had a $50,000 fair value when it was reclassified from trading to available-for-sale. an available-for-sale security costing $75,000, written down to $30,000 in year 2 because of an other-than-temporary impairment of fair value, had a $60,000 fair value on december 31, year 3. what is the net effect of the above items on smoke’s net income for the year ended december 31, year 3?

Answers: 3

Business, 22.06.2019 15:30, thall5026

Calculate the required rate of return for climax inc., assuming that (1) investors expect a 4.0% rate of inflation in the future, (2) the real risk-free rate is 3.0%, (3) the market risk premium is 5.0%, (4) the firm has a beta of 2.30, and (5) its realized rate of return has averaged 15.0% over the last 5 years. do not round your intermediate calculations.

Answers: 3

Business, 22.06.2019 16:00, bossboybaker

Analyzing and computing accrued warranty liability and expense waymire company sells a motor that carries a 60-day unconditional warranty against product failure. from prior years' experience, waymire estimates that 2% of units sold each period will require repair at an average cost of $100 per unit. during the current period, waymire sold 69,000 units and repaired 1,000 units. (a) how much warranty expense must waymire report in its current period income statement? (b) what warranty liability related to current period sales will waymire report on its current period-end balance sheet? (hint: remember that some units were repaired in the current period.) (c) what analysis issues must we consider with respect to reported warranty liabilities?

Answers: 1

You know the right answer?

If a revenue in total for a month was $9459, fixed expenses were $9,000 and variable expenses were $...

Questions in other subjects:

Chemistry, 14.07.2019 16:50

Biology, 14.07.2019 16:50

Social Studies, 14.07.2019 16:50

Arts, 14.07.2019 16:50