Business, 03.07.2019 09:30 noeliaalvarado

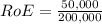

Acompany’s net income after tax is $50,000. shareholder’s equity of the company is $200,000 and its long-term liability is $30,000. what is the company’s return on equity? a. 15% b. 20% c. 25% d. 30% e. 35%

Answers: 1

Other questions on the subject: Business

Business, 22.06.2019 00:50, emma3216

cranium, inc., purchases term papers from an overseas supplier under a continuous review system. the average demand for a popular mode is 300 units a day with a standard deviation of 30 units a day. it costs $60 to process each order and there is a five−day lead−time. the holding cost for a paper is $0.25 per year and the company policy is to maintain a 98% service level. cranium operates 200 days per year. what is the reorder point r to satisfy a 98% cycleminus−service level? a. greater than 1,700 unitsb. greater than 1,600 units but less than or equal to 1,700 unitsc. greater than 1,500 units but less than or equal to 1,600 unitsd. less than or equal to 1,500 units

Answers: 1

Business, 22.06.2019 10:50, iaminu50

Jen left a job paying $75,000 per year to start her own florist shop in a building she owns. the market value of the building is $120,000. she pays $35,000 per year for flowers and other supplies, and has a bank account that pays 5 percent interest. what is the economic cost of jen's business?

Answers: 3

Business, 22.06.2019 20:10, NorbxrtThaG

Assume that a local bank sells two services, checking accounts and atm card services. the bank’s only two customers are mr. donethat and ms. beenthere. mr. donethat is willing to pay $8 a month for the bank to service his checking account and $2 a month for unlimited use of his atm card. ms. beenthere is willing to pay only $5 for a checking account, but is willing to pay $9 for unlimited use of her atm card. assume that the bank can provide each of these services at zero marginal cost. refer to scenario 17-5. if the bank is unable to use tying, what is the profit-maximizing price to charge for a checking account

Answers: 3

Business, 22.06.2019 20:50, aberiele1998

You are bearish on telecom and decide to sell short 100 shares at the current market price of $50 per share. a. how much in cash or securities must you put into your brokerage account if the broker’s initial margin requirement is 50% of the value of the short position? b. how high can the price of the stock go before you get a margin call if the maintenance margin is 30% of the value of the short position? (input the amount as a positive value. round your answer to 2 decimal places.)

Answers: 3

You know the right answer?

Acompany’s net income after tax is $50,000. shareholder’s equity of the company is $200,000 and its...

Questions in other subjects:

Mathematics, 22.11.2019 03:31

English, 22.11.2019 03:31

Mathematics, 22.11.2019 03:31

English, 22.11.2019 03:31

Mathematics, 22.11.2019 03:31

Mathematics, 22.11.2019 03:31