Business, 05.07.2019 09:00 Sashakimora2020

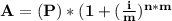

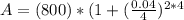

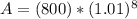

Plzzz , i have limited time and i will give brainliest. q1 selena has placed $500 in an account that pays simple interest of 5 percent annually. selena will have earned $ _.00 in interest by the end of the year. q2 suki has placed $800 in an account that pays 4 percent interest compounded quarterly. at the end of two years (eight quarters), the balance in the account will be $__ . that means suki will have earned $ in interest during that time. (round your answers to the nearest cent.) what will be the balance in the account at the end of two years (eight quarters)? how much interest will suki have earned during that time? (round your answers to the nearest cent.) q3 jessica is considering putting $50 into a money market account that pays a 4 percent annual interest rate. it will take year(s) for the money to double to $100. (use the rule of 72 to find the answer.) every mark you put the answer in that place. plz label the answer with q1 etc

Answers: 1

Other questions on the subject: Business

Business, 21.06.2019 23:00, gobbler80

Employees of dti, inc. worked 1,600 direct labor hours in january and 1,000 direct labor hours in february. dti expects to use 18,000 direct labor hours during the year, and expects to incur $22,500 of worker’s compensation insurance cost for the year. the cash payment for this cost will be paid in april. how much insurance premium should be allocated to products made in january and february?

Answers: 1

Business, 22.06.2019 11:40, rmcarde4432

Fanning company is considering the addition of a new product to its cosmetics line. the company has three distinctly different options: a skin cream, a bath oil, or a hair coloring gel. relevant information and budgeted annual income statements for each of the products follow. skin cream bath oil color gel budgeted sales in units (a) 110,000 190,000 70,000 expected sales price (b) $8 $4 $11 variable costs per unit (c) $2 $2 $7 income statements sales revenue (a × b) $880,000 $760,000 $770,000 variable costs (a × c) (220,000) (380,000) (490,000) contribution margin 660,000 380,000 280,000 fixed costs (432,000) (240,000) (76,000) net income $228,000 $140,000 $204,000 required: (a) determine the margin of safety as a percentage for each product. (b) prepare revised income statements for each product, assuming a 20 percent increase in the budgeted sales volume. (c) for each product, determine the percentage change in net income that results from the 20 percent increase in sales. (d) assuming that management is pessimistic and risk averse, which product should the company add to its cosmetics line? (e) assuming that management is optimistic and risk aggressive, which product should the company add to its cosmetics line?

Answers: 1

Business, 23.06.2019 02:00, mayalp

Here are the expected cash flows for three projects: cash flows (dollars) project year: 0 1 2 3 4 a − 6,100 + 1,275 + 1,275 + 3,550 0 b − 2,100 0 + 2,100 + 2,550 + 3,550 c − 6,100 + 1,275 + 1,275 + 3,550 + 5,550 a. what is the payback period on each of the projects? b. if you use a cutoff period of 2 years, which projects would you accept?

Answers: 2

You know the right answer?

Plzzz , i have limited time and i will give brainliest. q1 selena has placed $500 in an account tha...

Questions in other subjects:

History, 31.07.2019 00:00

Mathematics, 31.07.2019 00:00

Computers and Technology, 31.07.2019 00:00

Computers and Technology, 31.07.2019 00:00

Biology, 31.07.2019 00:00

.

.