Business, 11.07.2019 01:00 Laylahlettiere

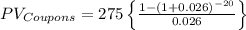

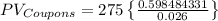

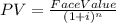

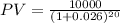

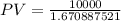

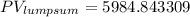

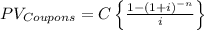

A10-year us treasury bond with a face value of $10,000 pays a coupon of 5.5% (2.75% of face value every 6 months). the semiannually compound interest rate is 5.2% (a six-month discount rate of 5.2/2 = 2.6%). what is the present value of the bond?

Answers: 1

Other questions on the subject: Business

Business, 21.06.2019 16:30, Elenegoggg

Which economic system could be characterized by the "iron fist", meaning a central authority figure has control over most of the economy? market economy command economy traditional economy free enterprise economy

Answers: 3

Business, 22.06.2019 13:40, allytrujillo20oy0dib

Randall's, inc. has 20,000 shares of stock outstanding with a par value of $1.00 per share. the market value is $12 per share. the balance sheet shows $42,000 in the capital in excess of par account, $20,000 in the common stock account, and $50,500 in the retained earnings account. the firm just announced a 5 percent (small) stock dividend. what will the balance in the retained earnings account be after the dividend?

Answers: 1

Business, 22.06.2019 15:30, thall5026

Calculate the required rate of return for climax inc., assuming that (1) investors expect a 4.0% rate of inflation in the future, (2) the real risk-free rate is 3.0%, (3) the market risk premium is 5.0%, (4) the firm has a beta of 2.30, and (5) its realized rate of return has averaged 15.0% over the last 5 years. do not round your intermediate calculations.

Answers: 3

You know the right answer?

A10-year us treasury bond with a face value of $10,000 pays a coupon of 5.5% (2.75% of face value ev...

Questions in other subjects:

Mathematics, 05.11.2019 06:31

Mathematics, 05.11.2019 06:31

Mathematics, 05.11.2019 06:31

Mathematics, 05.11.2019 06:31

History, 05.11.2019 06:31

Mathematics, 05.11.2019 06:31

coupon payments, so the number of periods, n = 20.

coupon payments, so the number of periods, n = 20. or 2.6% per period.

or 2.6% per period.