Business, 11.07.2019 07:00 imknutson962

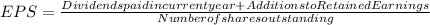

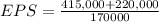

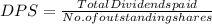

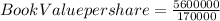

Makers corp. had additions to retained earnings for the year just ended of $415,000. the firm paid out $220,000 in cash dividends, and it has ending total equity of $5.6 million. the company currently has 170,000 shares of common stock outstanding. a. what are earnings per share? (do not round intermediate calculations and round your answer to 2 decimal places, e. g., 32.16.) b. what are dividends per share? (do not round intermediate calculations and round your answer to 2 decimal places, e. g., 32.16.) c. what is the book value per share? (do not round intermediate calculations and round your answer to 2 decimal places, e. g., 32.16.) d. if the stock currently sells for $65 per share, what is the market-to-book ratio? (do not round intermediate calculations and round your answer to 2 decimal places, e. g., 32.16.) e. what is the price-earnings ratio? (do not round intermediate calculations and round your answer to 2 decimal places, e. g., 32.16.) f. if the company had sales of $7.45 million, what is the price-sales ratio? (do not round intermediate calculations and round your answer to 2 decimal places, e. g., 32.16.)

Answers: 1

Other questions on the subject: Business

Business, 22.06.2019 11:30, fjjjjczar8890

Which of the following statements about cash basis accounting is true? a. it is more complicated than accrual basis accounting. b. the irs allows all types of corporations to use it. c. it follows gaap standards. d. it ensures the company always knows how much cash flow it has.

Answers: 2

Business, 22.06.2019 22:10, Har13526574

jackie's snacks sells fudge, caramels, and popcorn. it sold 12,000 units last year. popcorn outsold fudge by a margin of 2 to 1. sales of caramels were the same as sales of popcorn. fixed costs for jackie's snacks are $14,000. additional information follows: product unit sales prices unit variable cost fudge $5.00 $4.00 caramels $8.00 $5.00 popcorn $6.00 $4.50 the breakeven sales volume in units for jackie's snacks is

Answers: 1

You know the right answer?

Makers corp. had additions to retained earnings for the year just ended of $415,000. the firm paid o...

Questions in other subjects:

Mathematics, 05.04.2021 18:30

Chemistry, 05.04.2021 18:30

English, 05.04.2021 18:30

,

,