Biology, 05.07.2020 16:01 gyexisromero10

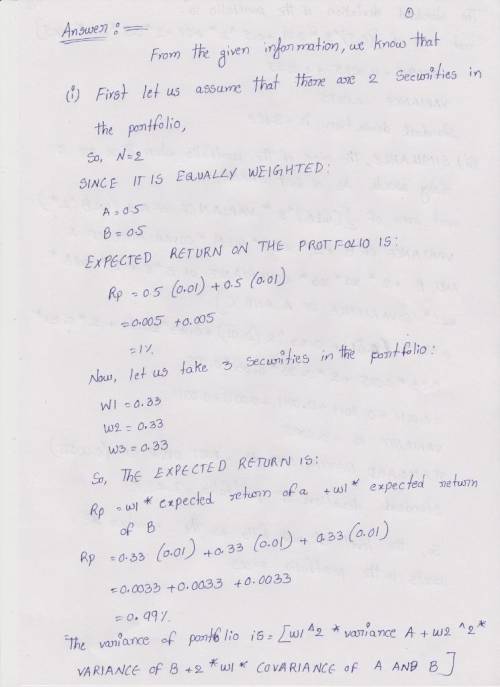

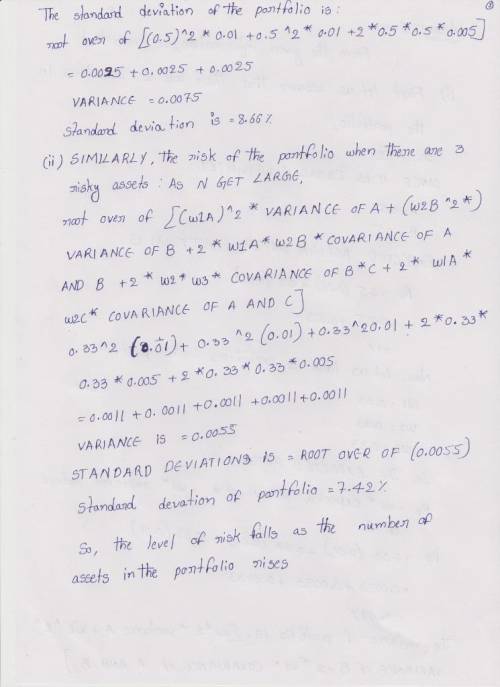

Assume N securities. The expected returns on all the securities are equal to 0.01 and the variances of their returns are all equal to 0.01. The covariances of the returns between two securities are all equal to 0.005.

What are the expected return and the variance of the return on an equally weighted portfolio of all N securities?

What value will the variance approach as N gets large?

What characteristic of the securities is most important when determining the variance of a well-diversified portfolio?

Can anyone help wit this question? this teacher is crazy

Answers: 2

Other questions on the subject: Biology

Biology, 22.06.2019 00:30, kcnawlay170

Name the types of burns one can get and which structures of the integument are damaged

Answers: 1

Biology, 22.06.2019 03:30, codycoker4200

What does the hardy-weinberg principle relate to? a. chances of survival of an organism b. frequency of alleles in a population c. natural selection in a species d. causes of evolution among organisms

Answers: 1

Biology, 22.06.2019 05:40, babyboogrocks5695

The body of water found at number 4 on the map above is the

Answers: 1

You know the right answer?

Assume N securities. The expected returns on all the securities are equal to 0.01 and the variances...

Questions in other subjects:

Mathematics, 30.11.2020 21:10

History, 30.11.2020 21:10

History, 30.11.2020 21:10

History, 30.11.2020 21:10

Social Studies, 30.11.2020 21:10

History, 30.11.2020 21:10

Health, 30.11.2020 21:10