Advanced Placement (AP), 08.12.2021 04:40 jonestmoney381

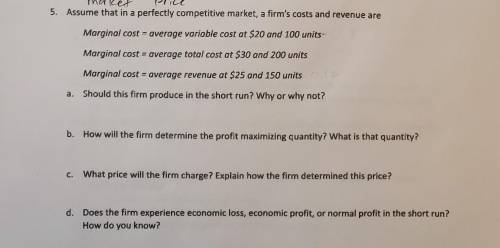

Assume that in a perfectly competitive market, a firm's costs and revenue are Marginal cost = average variable cost at $20 and 100 units- Marginal cost = average total cost at $30 and 200 units Marginal cost = average revenue at $25 and 150 units = a. Should this firm produce in the short run? Why or why not? b. How will the firm determine the profit maximizing quantity? What is that quantity? C. What price will the firm charge? Explain how the firm determined this price? d. Does the firm experience economic loss, economic profit, or normal profit in the short run? How do you know?

Answers: 3

Other questions on the subject: Advanced Placement (AP)

Advanced Placement (AP), 26.06.2019 09:10, Redhead667

What is a purpose of using a standardized recipe in a food service establishment? creativitycan be adjusted based upon inventorycan be adjusted for guest preferenceconsistency .

Answers: 2

Advanced Placement (AP), 27.06.2019 05:30, limelight11

The law of inertia states objects that are moving continue to move, and alternatively objects that are static remain static, unless in both instances the objects are acted upon by another force

Answers: 1

You know the right answer?

Assume that in a perfectly competitive market, a firm's costs and revenue are Marginal cost = averag...

Questions in other subjects:

Mathematics, 20.09.2020 06:01

Mathematics, 20.09.2020 06:01

Computers and Technology, 20.09.2020 06:01

Geography, 20.09.2020 06:01

English, 20.09.2020 06:01